Key Points

- A pet insurance plan for multiple pets can help lower premiums, with some providers offering 5-10% off for each additional pet you enroll.

- Low-cost plans may be tempting, but they often come with high deductibles, low annual limits, and a long list of exclusions, leaving you to pay more out of pocket.

Many pet owners don’t limit their love to just one pet. After all, who doesn’t love a big fur family?

But as your pet family members grow in number, you face double (or triple) trouble when it comes to veterinary care. Caring for multiple pets potentially means more accidents and illnesses, which can lead to more vet visits and more money spent out of pocket.

So, what’s a pet owner to do when they want to maintain the health and wellness of multiple pets?

A pet insurance plan for multiple pets can help you keep costs under control. Not only will your entire pack enjoy the benefits of pet insurance, but you can also save with multi-pet discounts.

In this guide, you’ll learn how to get pet insurance for multiple pets and what benefits you can expect. Whether you’re a two-pet or eight-pet household, here’s what you should know.

How does pet insurance work for multiple pets?

Pet insurance plans typically reimburse pet parents for a portion of their eligible vet bills after they meet their deductible up to the plan’s annual coverage limit each year. Here’s how it works: When your dog or cat gets veterinary care, you pay their bills as usual. Then, you file a claim with your provider, and if it’s approved, you’re reimbursed for a portion of the cost, usually between 50-90%. Pet parents can continue to submit claims for reimbursement until they hit their plan’s annual limit. These generally range from as low as $2,500 to as high as unlimited.

With Pumpkin Pet Insurance plans, it doesn‘t matter which veterinarian you visit, either. The coverage applies to all eligible veterinary care nationwide and in Canada.

The difference between pet insurance for multiple dogs vs. one dog is that the costs are, well, multiple. The math is pretty simple: you’re visiting the vet more often than you would with only one pet. To make care more affordable, pet insurance providers like Pumpkin offer multi-pet discounts. This lets you save up to 10% on a plan for each additional dog or cat you enroll.

Each pet in your household can still get their own plan tailored to their needs. However, you’ll typically save money if you sign up multiple pets with the same insurance provider.

You can get a multi-pet discount when you enroll an additional pet with a Pumpkin Pet Insurance plan. That means that you receive a 10% multi-pet discount for each additional pet you enroll. Learn more and get a free quote today!

Does pet insurance for multiple cats work the same for multiple dogs?

Yes, getting pet insurance for multiple cats is the same as for multiple dogs. And if you have one or more cats and dogs, you can still benefit from multi-pet discounts with Pumpkin.

Keep in mind that the cost of pet insurance can vary a lot between pets. Pet insurance providers calculate a plan’s cost based on a number of factors, including the pet’s species, breed, age, and zip code. Other features, like the reimbursement rate, deductible, and annual limit you choose, can also impact the cost.

Do I need separate policies for each pet?

There’s no one answer to this. The way each pet insurance plan works may be different. You may be insuring multiple pets under one pet insurance policy, or taking out a separate policy for each pet, which is how Pumpkin handles multi-pet insurance. Take your time and carefully study the plans you’re interested in to see how they work.

By comparing different pet insurance plans, you can get your pets the best care at the best cost.

Does insuring multiple pets lower my monthly premiums?

Yes, it can. If you’re looking for low-cost pet insurance for multiple pets, multi-pet discounts can make a big difference in cutting down your overall monthly cost — because more pets should mean more perks.

How do annual limits work for multiple pets?

Think of your annual limit as your pet insurance’s spending cap for eligible vet bills. If you have multiple pets, each one might have their own limit, or they could all share a single cap.

Some budget-friendly plans may look like a steal at first. But if you’re searching for low-cost pet insurance for multiple pets, check whether the lower premiums come with lower coverage limits, too. As an example, let’s say one of your pets needs a costly surgery that triggers your annual limit. For the rest of the year, you could end up paying out of pocket for all your pets’ care.

Premium pet insurance plans have higher annual limits, and some providers like Pumpkin even offer plans with no annual limits at all.

How do deductibles work with multiple pets?

There are a lot of differences between human health insurance and pet insurance, but annual deductibles aren’t one of them. As with many health plans, you’ll need to meet your annual deductible before you can be reimbursed for eligible vet bills.

If you want a low deductible (with Pumpkin, you can choose plans with deductibles as low as $100 a year), then expect to pay slightly higher insurance premiums. Your insurance premium is the monthly payment that maintains your insurance coverage. If you want to pay lower premiums, then opt for a higher deductible (Pumpkin also offers $500 and $1,000 deductible options).

Always double-check your insurance policy for each pet. You might be able to choose different options for each plan, like paying a separate annual deductible for each pet. This deductible amount may vary depending on your plan.

What does reimbursement rate mean for multiple pets?

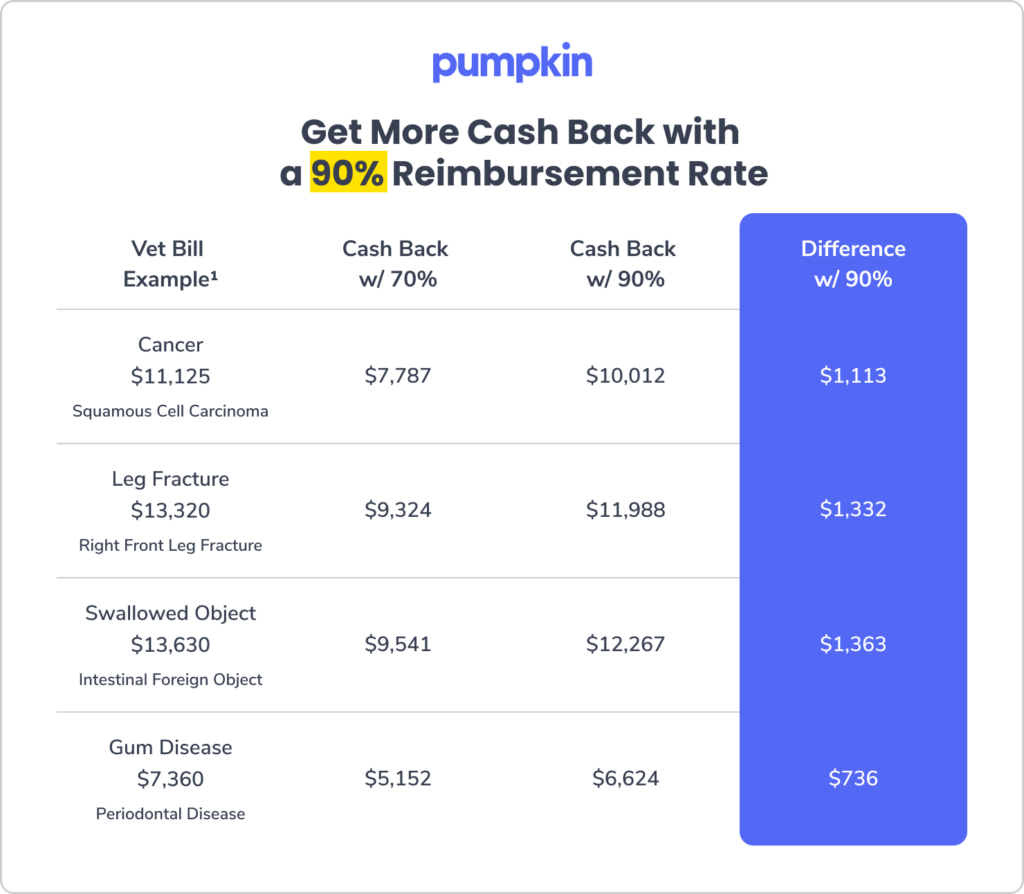

The reimbursement percentage is the portion of eligible vet bills that your insurance plan pays back after you’ve met your deductible. A higher percentage means you get more money back, but it can also mean a slightly higher monthly premium.

Some pet insurance providers keep their prices low by covering less of your bill, sometimes as little as 50%. But with Pumpkin Pet Insurance plans, you can get up to 90% reimbursement for eligible vet costs, which means more cash in your pocket and potentially big savings over time.

Can I choose different reimbursement rates for each pet?

Yes, many pet insurance providers let you tailor coverage for each pet, so you can pick the reimbursement rate that best suits their individual needs.

When selecting a reimbursement rate for your pet, it’s important to consider both their current and future care needs. A lower rate might feel sufficient for a healthy puppy today, but as they grow into an older dog and the risk of accidents or illnesses increases, a higher reimbursement rate could make a significant difference in how much money you get back on eligible veterinary expenses.

While many pet insurance providers allow you to adjust your reimbursement rate later on, some may only let you decrease it — not increase it — after enrollment or renewal. That’s why it’s wise to choose a rate upfront that you feel confident will support your pet through every stage of life.

Will I need to file separate claims for each pet?

Yes, you’ll have to submit claims individually for each pet, even if they’re on the same policy. The best pet insurance for multiple pets keeps the claims process as simple as possible, no matter how many pets you have. For example, Pumpkin has a fully mobile-optimized website accessible from your desktop, tablet, or smartphone, making the claims process that much easier.

What’s the best pet insurance plan for multiple pets?

This completely depends on you and your pets’ needs. We recommend considering your pets’ unique health needs, age, breed, and lifestyle, as all of these factors may make them more likely to require expensive vet care. For instance, an active Golden Retriever may be more likely to suffer costly joint injuries that require surgery. In that case, you might want to pick a plan with higher annual limits and lower deductibles. Pay close attention to reimbursement rates as well, as a 50% or 90% reimbursement rate can make a huge difference after a costly accident.

With Pumpkin Pet Insurance plans, you always have the option to get up to 90% reimbursement rates for each pet. Want to know what other pet insurance providers offer? Compare Pumpkin’s extensive multi-pet coverage to other insurance providers like Trupanion or Lemonade with our no-frills comparison page.

Do I need to use the same pet insurance provider for all my pets?

You don’t have to, but keeping all your pets under the same provider makes life a lot easier. By keeping all your pets covered with the same provider, you only have to keep track of one set of policies. Managing claims, renewals, and cancellations is also much simpler when everything is in one place — no juggling different policies or providers. Plus, if you pick a provider that offers a multi-pet discount, you could save a significant amount on insurance premiums over time if you have two or more pets.

What does pet insurance cover for my pets?

No matter the size of your fur family, all pets can have unexpected accidents and illnesses when you least expect them. Luckily, veterinary medicine has come a long way. Plus, the best pet insurance plans help pet parents say ‘yes’ to the best care by reimbursing you for a large portion of eligible vet bills.

Unexpected accidents and illnesses can include:

- Ingesting harmful substances like toxic plants and unsafe human foods like garlic or chocolate

- Swallowing foreign objects, including socks, bones, and charging cables

- Injuries from bite wounds or broken bones

- Respiratory illnesses such as kennel cough or influenza

- Parasites such as ticks, fleas, heartworms or ringworms

- Dental diseases, including periodontal disease

- Digestive illnesses, including pancreatitis or inflammatory bowel syndrome

- Behavioral conditions such as separation anxiety, aggression, fears, or phobias

- Chronic conditions like heart disease, kidney disease, diabetes, and arthritis

- Hereditary conditions such as hip dysplasia and brachycephalic obstructive airway syndrome

- Cancers, from mast cell tumors and lipomas to lymphoma and osteosarcoma

- Skin problems such as hot spots, rashes, and sudden growths

Pet insurance plans, even multi-pet ones, won’t cover pre-existing conditions or routine preventive care. So, to get the most from your pet insurance, sign up for coverage before any health issues arise.

Why might a Pumpkin Pet Insurance plan be the right fit for your family?

Pumpkin wants to have your pet’s back for life. Unlike some providers, Pumpkin won’t reduce coverage as your pets age, hike up restrictions, or drop coverage when your pet needs it most.

If you’re looking for the best pet insurance for multiple pets, here are a few perks of joining the Pumpkin pack:

- All pets 8 weeks and older can enroll in accident & illness coverage.

- Choose from individualized dog insurance plans and cat insurance plans.

- Pumpkin plans have no upper age limits for older pets. This means you can enroll both your new puppy and your senior kitty if you’d like.

- Pumpkin plans offer all pet parents the option of 90% cash back on eligible vet bills.

- No extended 6-month or 1-year waiting period for knee injuries or hip dysplasia.

- And, of course, you’ll also get that 10% multi-pet discount for each additional pet you enroll.

Pet insurance plans can give you peace of mind that you can provide the best accident & illness care for your pets when they need it most. Curious how much pet insurance plans would cost you for multiple pets? Get your free pet insurance quote from Pumpkin today.

DISCLOSURE