Key points

- Pet insurance is designed to cover unexpected accidents and illnesses.

- Preventive care plans typically include annual wellness exam costs, preventive vaccines, and other routine check-ups.

- Many pet insurance companies consider preventive care a wellness plan you can add to your pet insurance package for an extra monthly fee.

Researching different options to help you plan ahead for your pet’s care can be confusing. You may be wondering, “Should I get a pet insurance plan, preventive care coverage, or both?” If this question is on your mind, you’ve come to the right place!

We’re breaking down the differences between pet insurance and preventive care coverage to help you choose the solution that’s right for you and your pet. Let’s start learning!

Pet insurance is helpful for pet parents, as it helps alleviate the cost of veterinary care if your pet gets hurt or sick — ensuring your pet can receive the best possible treatment. However, many pet parents are surprised when their pet insurance plan doesn’t cover wellness visits or vaccinations. That’s because these items are considered routine care, and pet insurance typically only covers accidents or illnesses.

The good news is that many pet insurance providers offer wellness packages that help you pay for important preventive care such as vaccinations, annual check-ups, and routine tests. Taking advantage of these options can help ensure your pet stays healthy and happy.

Researching different options to help you plan for your pet’s care can be confusing. You may be wondering, “Should I get a pet insurance plan, preventive care coverage, or both?” If this question is on your mind, you’ve come to the right place! We’re breaking down the differences between pet insurance and preventive care coverage to help you choose the solution that’s right for you and your pet. Let’s start learning!

So, what’s the difference between pet insurance and preventive care coverage?

Pet insurance plans and preventive care packages make it easier for you to cover your pet‘s eligible vet care costs. Both pet insurance and preventive care coverage are important, and together, they can help your pet live a long and healthy life.

The main difference between the two is that pet insurance plans are designed to help you pay for unexpected accidents and illnesses that happen in the future, while preventive care packages or plans help you pay for the expected, routine medical care your pet will need year-round throughout their life (like vaccinations or fees for annual vet check-ups).

In both cases, veterinary care can cost a significant amount of money, which is why enrolling in a pet insurance plan and adding on a preventive care package can give you the best of both worlds.

What is a preventive care package or plan and how does it work?

From life-saving vaccines to parasite screening tests, routine care is an essential part of keeping your pet healthy and detecting health issues early on. A preventive care package is designed to help you cover routine care you know your pet will need throughout the year. Not only that, but preventive care and testing can uncover significant health issues in dogs as young as two years old.

Let’s take a look at Pumpkin’s wellness package as an example. Pumpkin’s wellness package is called Preventive Essentials, and it includes a 100% refund for three crucial preventive care services: the fee for your pet’s annual wellness exam, key vaccine(s), and parasite screening test(s). While not insurance, it’s an optional benefit that can be added to a Pumpkin plan. It’s a great way to help you stay up to date on your pet’s wellness care every year, which, in turn, can help prevent disease and stop illnesses in their tracks.

Some providers call their wellness offering a wellness plan. Usually, with a pet wellness plan, you pay a monthly fee (this varies) that goes toward covering the cost of preventive veterinary care based on a benefits schedule, where a certain dollar amount is allotted to a range of preventive care services.

For example, your plan may allow $75 worth of spending on dental cleaning per year. You can think of it as an annual payment plan where the costs are spread out over the year. A plan like this can be helpful if you take full advantage of the services offered, but not every service available is a typical annual expense.

Remember that some wellness plans are not insurance products, while other wellness plans may be filed as insurance products. Some pet insurance providers do offer them as add-ons for an extra fee to their pet insurance plans.

What does preventive care cover?

Wellness benefits and the services covered vary between the different types of wellness plans that providers offer. For a full comparison of providers and their wellness coverage, our handy compare page can help.

For example, different preventive care plans or packages may cover a combination of these services:

- Fees for annual wellness exams

- Preventive vaccines

- Yearly blood work (e.g. for heartworm tests and flea and tick screening)

- Fecal exams (for parasites like intestinal worms)

- Spay/neuter procedure

- Regular dental cleanings

- Grooming services

- Deworming medication

It’s important to remember that with preventive care plans that work on a benefit schedule, you get the best value when you use every single service offered in a given year. That can be tricky, though, because some of the services offered are not typical annual expenses, such as a spay/neuter procedure.

Let’s put that into perspective: imagine that over a year, your monthly payments for a wellness plan add up to $1000, but that year you only claim reimbursement for $600 worth of preventive care services as your pet didn’t need every service. That’s $400 you paid out but didn’t receive any benefits for. Plus, many preventive care plans work on a use-it-or-lose-it basis, so any benefits you don’t use in a year wouldn’t roll over.

Benefits of regular check-ups and pet wellness care

Preventive care is crucial because it allows you to address potential issues before they become more complicated — and costly for pet parents. In a nutshell, here are the most common advantages of regular check-ups:

1. They can help detect — or even prevent — common chronic issues

Regular check-ups allow veterinarians to monitor your pet’s overall health, enabling them to detect potential problems early.

For instance, routine blood tests can identify changes in your pet’s liver or kidney function even before symptoms appear. This proactive approach can help prevent the onset of severe illness and minimize the need for costly and invasive treatments down the road.

2. They can improve adult and senior pets’ health

As animals age, their healthcare needs evolve, making regular check-ups even more critical.

Routine vet visits provide an opportunity to address age-related concerns, such as arthritis, dental disease, and obesity. Your veterinarian can recommend dietary adjustments, prescribe medications, or suggest lifestyle changes that can significantly improve your pet’s quality of life.

Addressing these issues early can help ensure that your fur companion enjoys their golden years in comfort.

3. They give you a chance to ask relevant questions and get answers regarding your pet’s health

Regular check-ups offer a platform on which to discuss any concerns or questions you may have about your pet’s health. Whether you have dietary inquiries, want to resolve behavioral issues in your pet, or have queries about preventive measures, your veterinarian is there to provide guidance and solutions.

Open communication ensures that you better understand your pet’s specific needs and can tailor their care accordingly.

4. They can help you save money in the long run

Contrary to the misconception that preventive care is expensive, it can save you a significant amount of money in the long run. Addressing health issues early often requires less intensive and costly treatments than if the condition goes undetected and progresses.

What is pet insurance?

A pet insurance policy helps pet parents prepare for their pet’s future health needs by reimbursing them for eligible vet bills for their pet’s unexpected accidents or illnesses. You may be thinking, I’m not sure if pet insurance is right for me because I’m not sure if it’s likely that an accident or illness will happen to my pet in the future.

The truth is that even young healthy pets can get up to mischief, and as many as 1 in 3 pets will need emergency vet care each year!20 It’s not nice to think about, but all the more reason to future-proof your pet’s health care.

Pet parents usually pay a monthly or annual premium for their pet insurance policy. The coverage that comes with their policy helps give them peace of mind that if unexpected accidents & illnesses do pop up in the future, they have help affording the eligible care their pet may need to recover. After all, there have been life-saving advancements in veterinary medicine – a good pet insurance plan may help you say ‘yes’ to the best of the best if covered accidents and illnesses arise.

For more in-depth info on how a pet insurance plan actually works and how you get reimbursed for eligible vet care, read our full pet insurance plan breakdown here.

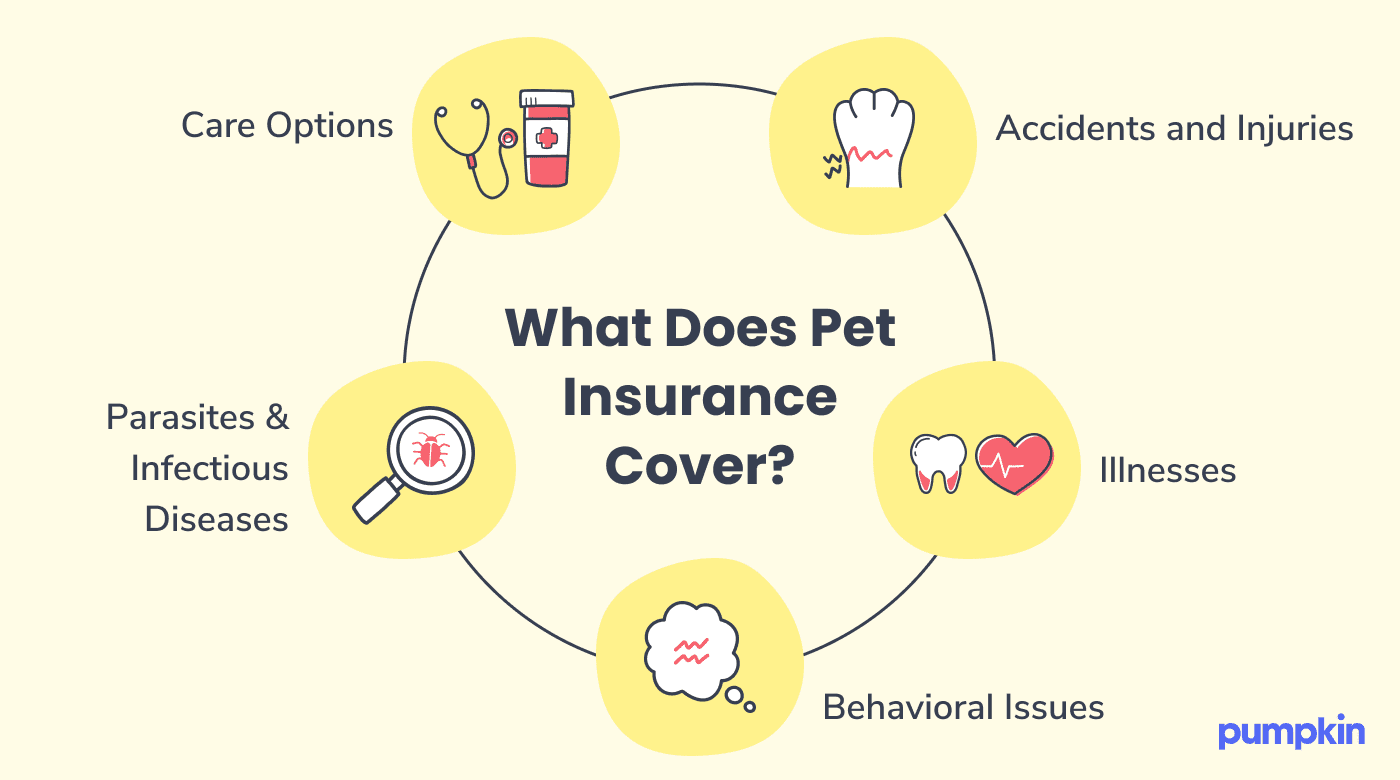

What does pet insurance cover?

Like all pet parents, we want surprise accidents & illnesses to stay well away from our pets. However, they do have a habit of popping up when we least expect it! Here are some types of coverage a pet insurance plan with extensive accident & illness coverage, like a Pumpkin plan, can offer:

Accidents and injuries:

- Swallowed objects, toxins, and poisons

- Orthopedic injuries like sprains or fractures

- Bites and wounds

Illnesses:

- Chronic conditions such as diabetes and arthritis

- Congenital conditions such as heart defects

- Hereditary conditions such as hip dysplasia

- Dental illnesses such as periodontal disease

- Behavioral issues such as separation anxiety

- Parasites & infectious diseases such as Lyme disease

- Digestive illnesses such as pancreatitis

Care options to treat covered accidents & illnesses:

- Emergencies & hospitalization

- In-clinic or virtual exam fees for accidents or illnesses

- Surgeries & specialized care

- Poison control hotline fees

- Eligible prescription medication and supplements for covered conditions

- Eligible diagnostic testing such as blood tests, urinalysis, fecal tests, x-rays, or ultrasounds

Always read your pet insurance policy documents to see exactly what your plan can cover.

How do you know which insurance companies offer preventive care?

To find pet insurance companies that offer preventive care alongside their policies, run online searches, read customer reviews, find relevant blogs, and seek recommendations from veterinarians or other pet owners.

Once you have a list of potential companies, carefully review their policy details. Look for comprehensive plans that include preventive care coverage, such as vaccinations, wellness exams, and routine screenings. Ensure the policy aligns with your pet’s needs and budget to make an informed choice. And remember to check whether the policy has exclusions for specific conditions, breeds, or pre-existing illnesses.

Pumpkin offers an optional wellness package called Preventive Essentials. It ensures refunds for routine care and includes coverage for annual exams, vaccines, and lab tests.

How do pet insurance and preventive care provide peace of mind?

Pet insurance and preventive care have many practical benefits, including a sense of inner peace for pet parents.

Pet insurance helps ensure that unexpected accidents or illnesses won’t force you to make difficult decisions based on cost, allowing you to prioritize your pet’s health over financial concerns. Meanwhile, preventive care offers proactive health management, allowing you to catch issues early and helping ensure your pet’s longevity. These advantages translate to more quality time together and a reduced emotional burden.

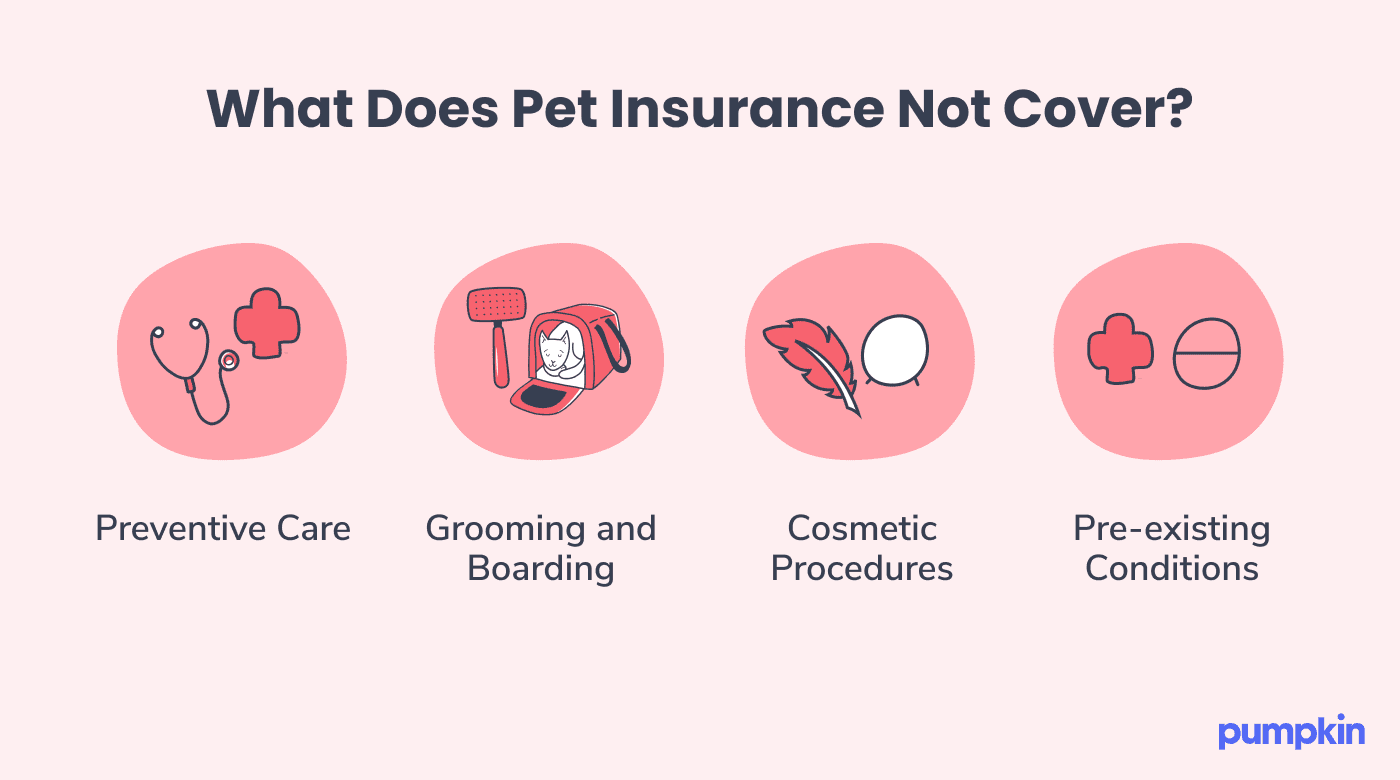

What does pet insurance not cover?

We know that most standard pet insurance plans can’t cover preventive care costs like annual wellness exams, teeth cleanings, preventive vaccines, and other care not related to unexpected accidents or illnesses.

These are also some common exclusions for most pet insurance plans. These include the following:

- Grooming services

- Boarding and travel costs

- Cosmetic or elective procedures

- Spay/neuter procedures

- Pre-existing conditions

Most pet insurance plans don’t cover pre-existing conditions, which are conditions that occur or show symptoms before coverage starts or during a waiting period. If your pet has already been diagnosed with a health issue that will require future medication or surgery, most pet insurance plans are unlikely to cover these costs since this was a condition that was present before your coverage started. Be sure to review your insurance plan’s policy for a full list of exclusions.

Which option is right for my pet?

If you decide to opt for both a pet insurance plan and a preventive care package, the benefits are twofold. You have help providing your pet with key routine care services as well as the future eligible vet care your pet may need to recover from an unexpected accident or illness.

One isn’t necessarily any better than the other because they’re designed for different health needs. Our philosophy is that it’s a great idea to get ahead of possible health issues with preventive care as well as be prepared for future accidents and illnesses that may come up in your pet’s life.

FAQs about pet insurance and preventive care

Pet insurance refers to an insurance policy that covers part of your dog or cat’s veterinary bills based on the coverage package and additions.

Preventive care is essential because detecting and preventing an illness promotes vitality and longevity while reducing the financial costs the treatment of such an illness requires.

Whether pet insurance includes preventive care depends on the insurance provider. For instance, Pumpkin offers a Preventive Essentials package you can add to your insurance to get refunds for routine care.

Most insurance providers consider dental cleaning as preventive care and offer it only as an addition to pet insurance. For example, Pumpkin plans cover dental illnesses and the exams, X-rays, treatment, surgery, and prescription meds used to diagnose or treat them, but not dental cleaning.

Pet insurance is generally not as cost-effective for preventive care alone since most providers don’t include it. However, preventive care is crucial for pet health and longevity. To cover these costs, consider setting aside a separate budget or choosing a company that offers affordable preventive care packages as an addition to pet insurance.

Preventive care may have policies that exclude pre-existing conditions or have limitations on vaccine combinations and bundled benefits.

Preventive care for your pet

Pet owners are often unsure if their pet insurance coverage automatically includes preventative care and if purchasing it has significant advantages.

However, giving your pet preventive care is among the best things you can do for them — and your peace of mind. It allows you to react to potential issues before they worsen, reducing your financial burden. Moreover, regular check-ups keep you informed about your fur baby’s health throughout the year.

Pumpkin offers pet insurance plans for dogs and cats with super-extensive coverage that gives pet parents the option of 80–90% cash back on eligible vet bills. Plus, you can easily add a Preventive Essentials package to your Pumpkin plan, giving yourself added peace of mind knowing your annual wellness exam fee and key vaccine(s) are covered. Fetch a free quote online today!

DISCLOSURE