Key Points

- September is National Pet Insurance Month: a chance to consider whether an insurance plan can benefit you and your beloved pet. (Spoiler: yes it can!)

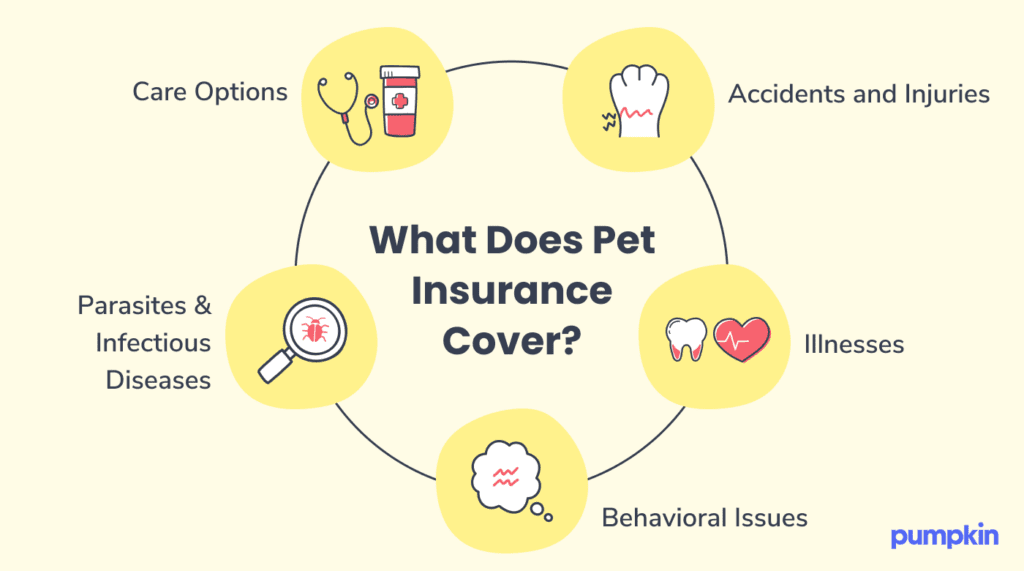

- Pet insurance plans can help you cover the cost of unexpected veterinary bills if your pet gets sick or hurt.

- Pumpkin has several options for insuring your dog or cat, and can reimburse you for up to 90% of eligible vet bills.

Let’s face it: Pet insurance can be confusing. From annual limits and deductibles to what’s covered (and what’s not), there are a lot of options to explore (and tons of new vocabulary to learn). Not to mention age limits, breed restrictions, pre-existing conditions, and how much you’ll pay at the end of the day… then again, your pet is your child, and you would do just about anything to get them the best care possible.

The thing is, as much as your dog or cat might want you to plan ahead for their accidents and illnesses, they can’t exactly tell you that. They also can’t warn you about their plan to raid the kitchen trash, or ask you to please clear the hallway for zoomies so they don’t injure themselves.

This Pet Insurance Month, we’ve made it simple to learn the basics of pet insurance: what’s covered, how much you’ll pay, and how it can ultimately help you give your pets the best possible care if they get sick or hurt.

Why is pet insurance worth it?

You’ve probably wondered if pet insurance is worth the money. Maybe your search engine sent you here because you asked that very question!

If your pet is young and healthy, you might not expect them to need expensive veterinary care. On average, the cost of caring for a dog in the U.S. is about $1,400 per year, and cat ownership costs about $1,150 per year — that includes the price of vaccines and boosters, annual exams, and screening for common diseases. However, those averages don’t factor in how much you’ll pay if your pet gets unexpectedly sick or hurt.

One in three pets in the U.S. will need emergency veterinary treatment in a given year, according to Forbes Advisor. Only 39% of American pet owners have enough savings to cover an emergency vet bill, which can range from a few hundred to a few thousand dollars. This is why pet insurance exists: to help you cover the costs that you can’t see coming.

Unfortunately, you can’t predict when your fur kid will get sick or hurt — but you can prepare for it. If you’re still not sure about it, follow these five simple steps to determine whether pet insurance is worth it for your fur family.

Pet insurance terms to know

Now that you know a bit about why pet insurance is so important, you might want to start doing some research. Pumpkin has a comprehensive list of all the pet insurance terms you need to know from A to Z.

Here’s a little introduction to your pet insurance ABC’s:

Age limits

Some pet insurance providers will reduce coverage or simply won’t insure pets past a certain age. For example, a provider may say pets age 12 and older can only get accident-only coverage or don’t let them enroll altogether.

Tip: Pumpkin Pet Insurance plans have no upper age limits and don’t reduce coverage as pets enter their golden years.

Behavioral issue or problem

An illness condition, either social or medical, that results from your pet’s action, inaction, or temperament that is abnormal, dysfunctional, or unusual. Whether it be separation anxiety or compulsive licking (Yes, that’s a thing!), some providers offer plans with coverage for behavioral issues in cats and dogs. Some others exclude this coverage, or make you pay an extra monthly fee to include it in your plan.

Tip: From destructive chewing to aggression, Pumpkin plans cover eligible behavioral issues in dogs and cats.

Claims

These are requests for reimbursement or application of coverage that you submit to your insurance provider. Be sure to include copies of your itemized vet bills so your provider can verify coverage and provide an accurate reimbursement.

Tip: Submitting a claim with Pumpkin is easy — just make sure to save your receipt or invoice from your pet’s treatment, and send it our way after you pay!

With resources like these at your fingertips, pet insurance can be as easy as A-B-C!

How pet insurance works

While some providers refer to their pet insurance plans as pet health insurance plans, this isn’t the most accurate description. It may seem odd, but pet insurance actually has more in common with your car insurance than your own healthcare coverage.

Pet insurance falls under the category of property and casualty insurance, which also includes homeowners’ insurance, renters’ insurance, and car insurance. Unlike some human health insurance plans, which may cover various types of healthcare including routine exams and vaccines, most pet insurance plans are designed to cover accidents and illnesses only.

It’s also important to understand that accident and illness pet insurance plans typically reimburse you directly for your pet’s eligible veterinary care costs when they get sick or hurt. It usually works like this:

- You pay for your pet’s veterinary treatment costs upfront.

- You submit a claim for the treatment your pet received.

- If the claim is approved, you receive reimbursement based on your policy details (such as reimbursement rate, deductibles, etc.)

It’s also important to note that, unlike a human health insurance HMO, pet insurance plans often don’t have in-network veterinary hospitals. As for Pumpkin, the pet insurance plans we offer cover eligible care for covered conditions from all licensed vets in the U.S. and Canada — so you don’t have to worry about network restrictions.

That’s just one of many common misconceptions about pet insurance debunked. If you’ve made it this far, you’re off to a great start . . . but make sure to check out our other pet insurance guides for more vital information about giving your pet the best possible care.

If you’d like to find out if Pumpkin has the right plan for your pet, get a quote! We’ll fetch it for free.